If your existing FHA mortgage was endorsed prior to June 1, 2009, you can refinance via the FHA Streamline Refinance program and pay reduced rates for both for upfront MIP and your annual mortgage insurance premium.

For an FHA Streamline Refinance that replaces a loan endorsed prior to June 1, 2009, the new FHA mortgage's upfront mortgage insurance is equal to 0.01 percent of the loan size. For example for a $100,000 mortgage, the FHA upfront mortgage insurance premium (MIP) will be only $10, which is added to your new loan balance.

Annual MIP FHA loans endorsed before June 1, 2009 are as follows:

If you are refinancing an FHA mortgage via the FHA Streamline Refinance program and your existing FHA mortgage was endorsed on, or after, June 1, 2009, your mortgage insurance premium schedule on the new loan is as follows.

For an FHA Streamline Refinance replacing a loan endorsed on, or after, June 1, 2009, the FHA upfront mortgage insurance premium is equal to 1.75 percent of your loan size. This is $1,750 for every $100,000 borrowed. The FHA automatically adds the $1,750 premium to your loan balance as an amount financed into your new loan. Furthermore, not all refinancing households will pay the full amount.

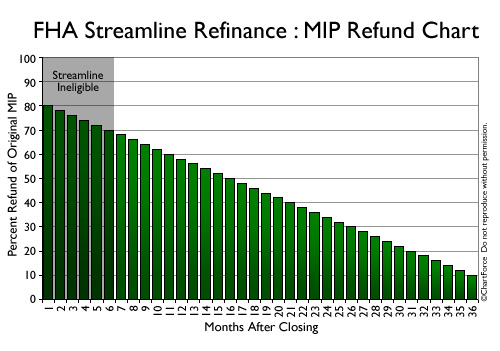

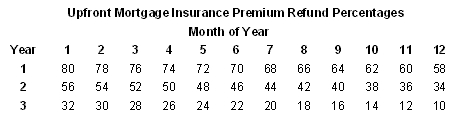

For FHA backed homeowners refinancing within the 3 years of their existing loan's start date, the FHA provides a refund on previously-paid upfront MIP. The size of the refund diminishes as the 3-year window elapses.

The FHA mortgage insurance chart is as follows:

For example, a homeowner who refinances an FHA mortgages after 11 months is granted a 60% refund on his initial FHA UFMIP. 30 days later, the refund drops to 58%. After another 30 days, it drops to 56%, and so on. Therefore, with the FHA Streamline Refinance program by refinancing your loan sooner, the bigger your refund, and the lower your total loan size, which in turn provides you with a lower monthly payment and preserves the home equity.

The annual MIP schedule for an FHA Streamline Refinance which replaces a loan from on, or after, June 1, 2009 is as follows:

Note, FHA mortgages with a loan amount over $417,000 are subject to an additional MIP fee. Call for details.

For some FHA-backed homeowners, annual mortgage insurance premiums are temporary. The FHA makes this determination based on several factors.

For homeowners using the FHA Streamline Refinance to replaces a loan endorsed prior to June 1, 2009, the FHA MIP will self-cancel once the loan is paid to 78% of the original purchase price or 78% of the appraised value for a refinance, even if the loan is subsequently refinanced. This special exception is granted only to FHA borrowers who have a FHA loan endorsed prior to June 1, 2009. Based on current interest rates are highly encouraged to refinance their existing FHA Loan.

For FHA Case Numbers assigned between June 1, 2009 and June 3, 2013, the FHA MIP will self-cancel once the loan is paid to 78% of the original purchase price or 78% of the appraised value for a refinance. However, if the loan is subsequently refinanced under the FHA Streamline Refinance program the FHA MIP will remain in force for the life of the loan or until the loan is refinanced using a conventional loan, or upon sale of the home.

For FHA Case Numbers assigned after June 3, 2013, the FHA MIP will remain for the life of the loan. As a result of the MIP being already being in force for the life of the loan, there is no long term negative impact in refinancing the mortgage loan in order to reduce the monthly mortgage insurance premium and/or interest rate.